From Super-2GreenEnergy-Intern Louis de Saint Phalle: Renewable Energy in Brazil

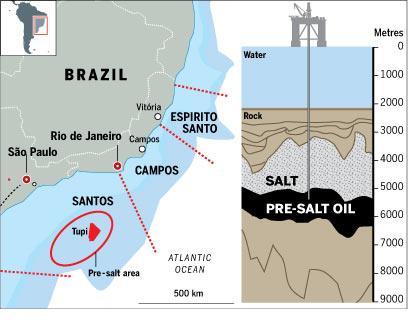

Before we get to renewables, I have to talk about the oil and gas industry because its size and growth potential are such that it would be odd for me to omit. They are booming– thanks to massive reserves in the Campos and Santos basins. Here is a quick picture:

Six fields in the Campos basin account for over 50% of the country’s crude oil production (of which the U.S. is the highest recipient), an area which also happens to contains the vast majority of Brazil’s natural gas. For example, Tupi (circled above) is expected to increase Brazil’s natural gas production by 50% alone. Major oil reserves and some natural gas are contained within pre-salt layers (also in picture). Since 90% of oil production happens offshore in very deep waters, there are technical hurdles to cross if the country is to explore them fully. As a result, Petrobras and the private sector are conducting pilot projects and generally working hard to increase production levels.

Just who is Petrobras? Up until recent years, this primarily government-owned publicly-traded corporation was the sole market player in the oil and gas sector. In time, however, the monopoly ceded to a consortium of international companies (e.g., Shell) which have played an important role in the transformation of resource exploration. However, Petrobras still plays a big role in all projects, owns most of the reserves and market shares, and has a stake in all major projects. In its 2013-2017 business plan, Petrobras laid out plans to invest $147.5 billion in exploration and production.

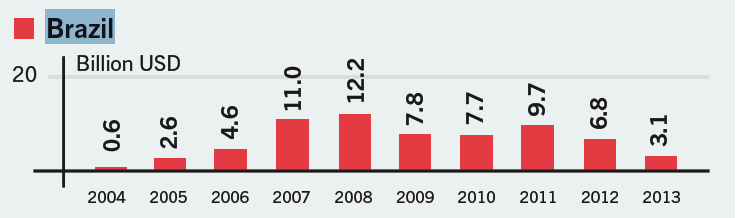

Here is a quick overview of renewable activity, starting with annual investment.

Illustrated by massive dams like the Itaipu generating station (second largest in the world), hydropower accounts for the vast majority of Brazilian electricity generation (~70-80%) and is still on the rise. Much of the still-untapped hydro potential plans to be addressed as the government intends to develop a staggering 48 new hydroelectric projects by 2020. These projects would total over 42 GW- almost three times our current entire solar market. It is also important to note that 80% of the new potential is set to come from 18 dams in the Amazon River basin, far away from main demand centers, and this causes power transmission and distribution losses. As the worst drought in more than 50 years cuts output, the government is also promoting other renewable sources.

On the wind side, successful policies, financing opportunities and good resources have made the industry flourish. On top of existing policies, the government established auctions in 2009 where the government sets a price ceiling and participants bid on lowest electricity price for projects. Although there have been some drawbacks with this system, it has largely been very successful. Investment costs have been reduced, the component market is growing steadily, and wind sites are larger and better in quality. Furthermore, the government is very flexible and looking at modifying policies as the environment changes. In 2013, wind represented the vast majority of investment in renewables in Brazil, and an increasing number of manufacturers are entering the market. All in all, the industry is alive and doing well.

Although Brazil’s solar PV market has more than doubled in the 2007-2013 period, it still represents less than 1% of total generation. Generally, the technology has not been able to compete with wind’s low production and financing costs. In response, the country is trying hard to kick-start the industry. Since last October solar has been successfully included in state-level auctions, with plans by the Ministry of Mines and Energy to hold them nationwide. Brazilian development bank BNDES has also put forward local-content rules: the bank will offer cheaper funding to solar projects using locally made components, and local production will become a mandatory requirement by 2017. Officials are still exploring policy in this area; rules that are too loose would overwhelm the market with Chinese manufacturers sensing a jackpot, while too stringent local-content rules would make the market unappealing and unstable. The country expects to contract 3.5 gigawatts of solar power between 2014 and 2018.

Dependence on foreign imports encouraged Brazil to develop extensive biofuel policies since the 1970s, and has been largely responsible for the nation’s extensive bio-power industry. Brazil is ranked third in biodiesel production globally, second in ethanol production, has a growing biomass market and bio-heat covers a significant portion of heat demand. In addition, the bio-power industry represents well over ten times the number of jobs than all other renewable sources combined. Among an array of sources, sugarcane ethanol is the leading biofuel and accounts for 13% of all transportation fuels. However, despite a production increased by nearly 20% just last year alone, a large chunk of production remained unused in 2013. In any case, the government is still very active in dealing with the industry. It still provides various tax credits and low interest loans for producers, raised the blend requirement for gasoline to 25% in 2013 and plans to expand Petrobras’ presence in the industry (yes- Petrobras is everywhere).

So what does the future hold? As the economy is growing, domestic electricity consumption is expected to increase over 50% by the end of the decade. If Brazil wants to increase the percentage of electricity coming from renewables it will mean very ambitious targets for the next decade. This is already the case. According to the draft of the 10-year energy plan (PDE 2023), wind and solar will account for 33% of all new generation capacity planned for the next decade. Their long-term strategy also entails cutting back on fossil fuel plant construction in favor of renewables.

Two parting thoughts: According to a Navigant research group report (Latin American Wind Power Assessment Report), Brazil is expected to have more wind power capacity by 2022 than all other Latin American nations combined. Second, in the first half of 2014 180 large-scale renewable projects were approved for construction totaling about 5GW (a very significant number) and requiring $8.3 billion in investment.

Keep an eye on Brazil.