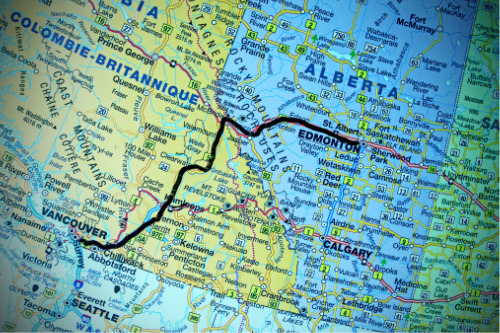

Insurance Giants Dropping Support for Canada’s Trans Mountain Pipeline

From this piece in InsuranceBusinessMag.com:

Talanx and Munich Re are joining some of the world’s largest financial institutions in steering clear of the oil sands sector. Trans Mountain is one of the most controversial energy projects in Canada’s history, which is why a mounting list of insurers refuse to back the project,” said Sven Biggs, Canadian oil and gas programs director at Stand.earth…..Currently, eight global insurers have implemented policies to limit or end insurance coverage for tar sands, including: AXA, AXIS Capital, Generali, The Hartford, Munich Re, Swiss Re, Talanx, and Zurich.

Reasoning includes:

• Protesters from Native American communities and the international support they receive based on their commitment to land stewardship. It’s really only a matter of time before courts block construction projects like these.

• The horrific public relations debacles that result from ruining the environment.

• The high probability that tar sands projects will be grossly unprofitable.

Good news.