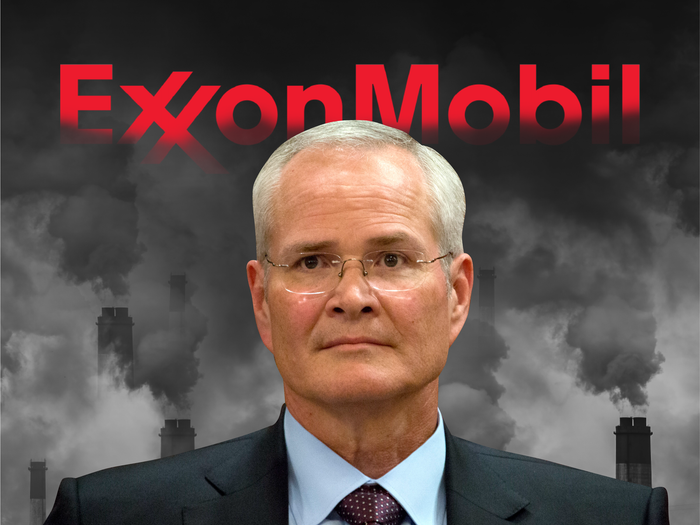

ExxonMobil Rebel Shareholders Want To Confront Climate Change

He asks, “Craig, is it right to read this as a stunning victory for environmental/climate concerns — & a powerful warning to the fossil fuel industry?”

Oh, absolutely.

Here’s what I wrote about this a few days ago: http://www.2greenenergy.com/2021/05/22/exxonmobil-4/. The entire industry is under tremendous pressure from several different directions:

• The plummeting costs of renewables

• The growing viability of electric transportation and popularity among consumers

• Divestment movements

• Litigation from shareholders and potential criminal charges re: hiding what they knew about climate change and thus the value of their assets

• A rising awareness that there is no path from burning hydrocarbons to decarbonization, i.e., that concepts like carbon capture and sequestration are BS.

• World governments (especially in the EU) banning the sale of new internal combustion engines after, say, 2030/2035

• PR from hell