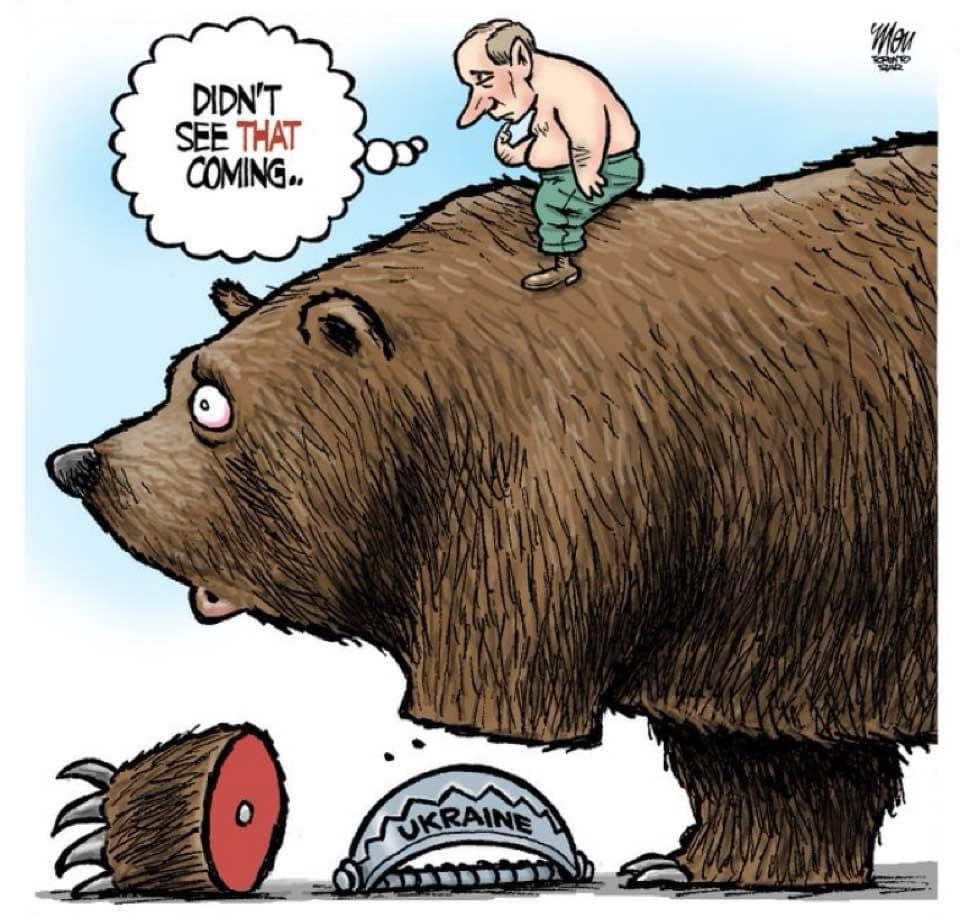

Helping Ukraine Remain Tough

We’d all like to think these depictions are fair and accurate, and, if they are, that the situation will remain in place until Russia simply gives up and goes home.

Those interested in tactics that the U.S. could take to put additional pressure on Russia will enjoy this suggestion from senior energy analyst Glenn Doty:

It has pained me for years how unforgivably stupid policy makers at large (from all parties) are with regards to one of our most powerful leverage tools that we have in situations like this: The SPR.

The Strategic Petroleum Reserve has 714 million barrels of oil (714 MMbbl). We could sell that oil at any time, and we could purchase oil to go into it at any time.

If we released 7 MMbbl/day for 60 days, effectively draining about 60% of the SPR, it would drop the price of oil to ~$30/bbl over that time frame. That would cut the value of Russia’s oil export by more than 200 million dollars per day during a time when they have difficulty trading or borrowing any other form of currency. The 12+ billion in incurred losses would be focused on the Russian oligarchs themselves – again when they have no other access to funds.

It would squeeze them, while simultaneously easing the burden for Americans over the next few months while normalcy continues to be restored from the pandemic.

Furthermore, it would take several months for that degree of excess to be pumped out of the market, so prices would remain low – even with reduced output from Russia – for many months. So as long as SWIFT is cut off, and their foreign assets are seized, every day of additional reduced oil price would continue to harm them.

It’s tremendous leverage, and still leaves us with ~280 MMbbl of oil in reserve, which would be sufficient for ~a year of military operations. We could then buy back the released oil – refilling the reserve – over the next few years in times when prices are lower.