Production Tax Credit for Wind Energy Extended

An old friend from college wrote me a few minutes ago, and commented:

Well we kicked the fiscal cliff down the road a bit so we can do some more kabuki theater a couple of months later…. CNN loves it.

Great metaphor, to be sure.

It was good to see that the Production Tax Credit (PTC) for wind was extended as part of the deal. It was also good to see that American Council on Renewable Energy (ACORE) President and CEO Vice Admiral (ret.) Dennis (“Denny”) V. McGinn made his usual “the glass is half full” comment:

As a result of the extension, over 37,000 American jobs will be saved, more renewable energy jobs will be added to our recovering economy, and domestic wind turbine manufacturing will resume in America’s 500 wind turbine manufacturing facilities. Today is a victory for many different forms of American-made renewable energy and the hard-working people who produce it.

I honestly wish I had Denny’s sunny disposition. It’s true that it’s better that the PTC got extended than dropped like a hot rock in this poisonous political atmosphere. But the overall top-level realities surrounding wind and the other forms of “new energy” remain as follows:

• They receive far fewer dollars in subsidies than the oil companies do, although the latter, 90-year-old industry, is the most profitable on Earth.

• The one-year extension of the credit raises the same old question yet one more time: what happens at the end of the year? In case it’s not obvious, potential investors aren’t attracted to the uncertainty that have become the norm for renewables.

• The main financial platform for the formation of capital for oil and gas exploration, i.e., Master Limited Partnerships (MLPs) remains unavailable for renewables. All that’s required to level the playing field here is a quick stroke of a pen from Congress, but the traditional energy folks and their crack legal teams are fighting this piece of fairness to the very death.

The idea that we’re honestly trying to encourage the development of clean energy is laughable.

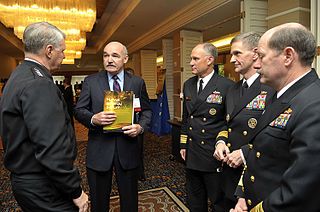

Having said that, again, I sincerely appreciate Denny’s viewpoints. When I interviewed him for my upcoming book (“Renewable Energy – Following the Money”) over breakfast in Washington, D.C. a few months ago, I even mentioned this. “You’re really the perfect person to run this organization,” I acknowledged. “Your resume couldn’t be any deeper, and your extremely senior connections with the DoD (Unites States Department of Defense) must be a big plus, given our military’s commitment to energy sources that don’t compromise national security. You deal on a day-to-day basis with all the stupidity and greed that I see from my standpoint at 2GreenEnergy, yet you face this garbage with total aplomb. I need to learn something from you. Perhaps, as they say, ‘one attracts more flies with honey than vinegar.'”

Denny responded with a brief smile and a pithy story about his days as a high-ranking Navy officer.

Maybe this is something for me to work on as a New Year’s resolution, but I’m not sure it’s in my DNA.

Why can’t the USA and the United Kingdom structure their Renewable energy policies a little more like Germany?

I am not saying we should necessarily adopt their policy wholesale, however it is clear that the success of Germany in boosting Renewable Energy production is mostly down to consistent policy over a long period of time.

I have read that in the oil markets, the cost of variability in price to the global economy through boom and bust, and changing levels of economic activity is the equivalent to an increase in average oil prices of around $10 per barrel. Inconsistent policy which creates frantic surges in demand followed by drought makes Renewable capacity more expensive than necessary as companies face substantial costs growing then shrinking their businesses – recruiting staff then making them redundant, and leasing / buying buildings which are soon under utilized, and driving manufacturing to markets with a more consistent policy.

A slightly less generous policy with consistency – which does not regularly expire and get reinstated would create far better conditions for investment, and avoid a substantial amount of disruption and wasted efforts.

Yes, I advocate a floor on gasoline prices to deal with this precise phenomenon.

Craig,

While I agree with much of what you’ve written here – obviously – I believe that the yearly deadlines on the PTC actually have served the wind industry well…

The PTC is a kickback on the original capital investment, rather than a per-kWh subsidy. So the looming loss of that kickback serves to create a sense of rush for investors – it’s use it or lose it.. so even if the timing isn’t perfect, the investors are pushing to get the infrastructure up as fast as possible so they don’t miss their window.

That’s probably helped wind.

It’s the continuing subsidies which result in harming an alternative energy platform – feed-in tariffs or green tags or other subsidies designed to give continual revenue throughout the lifetime of the project. But the PTC is just money returned on the core investment, and the sense of looming loss of the PTC should clear away procrastinators and force projects through more quickly.

This is probably one of the rare points where an unintended consequence is a positive one.

Very interesting. I suppose you’re right. Thanks.