US Federal Government Subsidies for the Oil Companies

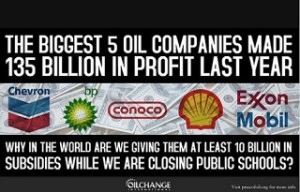

He writes: The myth keeps getting repeated, even by those who know better, that the US oil industry receives “hundreds of billions” in taxpayer subsidies, when in fact the claim is not only untrue, but made even more false since the oil industry is also the largest, and most valuable US taxpayer. But still advocates repeat the myth.

I went on a campaign to get to the bottom of this back in 2010, and the calculations that I deem most credible are those of the Environmental Law Institute, whose senior scientists I happen to know via my interviewing them for my first book (Renewable Energy–Facts and Fantasies). I encourage anyone interested in the subject to download it here. The chart shown here summarizes the enormously comprehensive report for those who want to cut to the chase.

Thanks for the additional clarity Craig. Your charts also do not allow for infrastructural benefits. The oil lobby weighed in heavily in favor of our national highway system. This has been cited as part of the demise of the railroads. Many today can’t imagine a world without the interstate road system just as they cannot imagine a world without oil.

Craig,

Boy, it’s hard to kill a convenient myth isn’t it ?

I say “Oil Companies” , you respond with a chart for “Fossil Fuel”, that includes the US coal industry.

In my post I provided a contextual definition, which you conveniently overlook, while persisting with the inclusion of business expense deductions which are available to any industry.

Even your own report states that the largest portion of what it classes as a “subsidy” is the US Foreign Tax Credit. This is a tax treaty available to any qualified US taxpayer, not just the Oil Industry and certainly doesn’t fit the accepted description of a “subsidy” within the context I provided !

[ ref; https://www.irs.gov/Individuals/International-Taxpayers/What-Foreign-Taxes-Qualify-For-The-Foreign-Tax-Credit%3F ]

The term “subsidy” can be a bit ambiguous, which why I provided a contextual definition. General acceptance of the term implies a granting by the government of an incentive either by grant of tax credit for a special purpose unique to a particular business or industry.

Your chart is also disingenuous because it compares the figure of $72 billion for fossil fuel over a 7 year period against $29 million for renewable energy.

That figure cunningly attempts to portray a disadvantage to the renewable fuel industry. But closer examination reveals three startling facts:

1) The revenue of the oil industry is more than 100 times greater than renewable energy so naturally the figure is higher as a gross and should be shown as a percentage of revenue.

2) Tax credits are claimed against profits and income. Very few renewable energy projects generate real profit.

3) Less than 1% of US energy is derived from Wind and Solar so on a percentage basis, (even on your own distorted figures) renewable energy receives more than 90 times the “subsidies” granted to the oil industry !!

Sorry Craig, but a Disraeli quipped, “there are lies, damned lies, and statistics !”. he should have added “myths”.

But here’s a challenge. Itemize the “subsidies” uniquely beneficial to the oil industry granted by the US government. I can list about 14, but these are all pretty archaic and most are due to expire. All in all, the US taxpayer subsidizes the entire oil industry to the tune of less than $1 billion per year.

Not a lot for an industry that pays more than $ 3 trillion in tax revenue.

Marco, You defined Subsidies very narrowly and then you complain because the world does not follow your definition. The tax that the oil companies are interesting but then we should offset this benefit with the use of the commons that they take. Externalities are also a benefit that have a very real economic impact and amount to a subsidy.

I proposed an alternative definition which you may have not noticed. It is part of politics 101 to understand what governments can do to provide incentives to change the behavior of people and in this case corporations. To narrowly define a “subsidy” as a grant is like a self for-filling prophecy that ignores all the benefits oil companies have sought and have been granted.

Your point about the size of the oil industry and the tax it pays is useful for a comparison of the dollar amounts it receives. But both of these points also beg the question of why are we giving subsidies to oil companies at all! They are not a fledgling industry in danger of collapse.

They are useful and beneficial to society but it is a benefit we are paying for as made clear by their huge profits. So you will please forgive me if don’t shed a tear for the oil companies and their financial situation.

@ Breath on the Wind,

Firstly, its not my definition. The definition is that accepted by the overwhelming majority of the general public. Nor is it just restricted to “grants”. The definition is used to determine special tax credits, incentives or other concessions unique ro that industry or business. (that’s a pretty wide definition).

Craig’s chart is disingenuous because it it’s terms of reference appear to accept that context, while knowingly distorting information to support a myth.

” Externalities “, are ambiguous,vague, and although some maybe maybe perfectly valid, are often a matter of conjecture and opinion. That makes comparisons difficult.

In reality, “oil companies” receive no identifiable “subsidies” from the US government. Even President Obama was forced to concede that his claims of $ 3-4 billion per year was inaccurate.

Bad, biased misinformation only helps confirm the beliefs of the “converted”. Unfortunately, the vast majority of the general public find such disinformation untrustworthy, and reject other more valid environmental information as a result. That’s why accuracy is important.

@ Breath on the Wind,

( Sorry, I got interrupted and accidentally pressed post.)

In conclusion, I have no argument with the reader who commented;

” Yes, I concede that oil companies receive no meaningful subsidies from the US government by the accepted definition. I also believe that externalities should start to be accurately defined, measured and included in tax policies.”

That reader expressed a valid and constructive political viewpoint worthy of a separate debate.