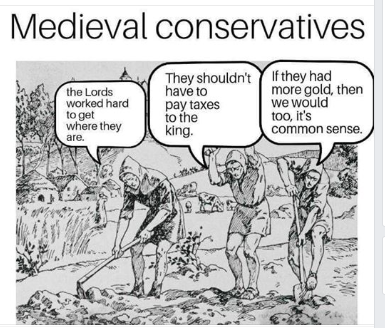

Trickle-Down Economics

One doesn’t need to be a Nobel laureate in economics, however, to understand the folly. When rich people get more money, it goes into their stock portfolios; when poor people get money, they spend it out of necessity. They buy food from grocers, who buy piano lessons for their kids from music teachers, who have their lawns cut by gardeners, who buy food from grocers, etc., thus stimulating the economy.

Of course, the fact that tax cuts for the wealthy benefits only the wealthy and does nothing for the economy is insufficient reason to make it stop. We live in a post-scientific world, where big money is the only driver of policy.

Craig,

What has happened to you? Do you really believe your increasing commitment to old fashioned socialist style economics? Do you really want to turn the US into the Venezuela so admired by Bernie Saunders?

Or is it just envy and hatred watching the US working class voters you once relied upon change their allegiance to a populist?

Trickle down economics does work! Even if the rich only “invest in stock portfolios”, what do you think those portfolio’s represent?

Those portfolios represent the expansion of private capital to fund economic growth in the private sector. That economic expansion and activity creates jobs and opportunities through increased competition and innovation, while preventing capital and industries moving offshore.

My clients invest their surplus wealth into the creation of whole new industries and technologies.

Without these “high net worth” individuals, very little new “clean technology” would be funded. I have to compete hard to attract capital investment against Bankers and Venture Capitalists on a global basis.

Thar isn’t easy, especially when currency fluctuations and other factors are considered. Most capital is produced from the retirement sector. these individual rely on their “stock portfolios” to maintain their increasingly expensive lifestyles as retirees live longer and consume more resources, particularly in the health sector.

More and more in the Western world, the young need to be financed by the elderly. More young attend college than ever before, they start on the property ladder latter, start smaller families later in life.

These economic trends mean public resources will become more strained unless more investment in the private sector can do more of the heavy economic lifting.

If you increase taxes on my affluent clients, I will simply move their investments ( and possibly themselves)to more tax friendly locations.

There will be no money for colleges, no money to invest in innovative industries, no money for government services, no employment and no opportunities for the young.

The ones who really suffer, are the working class and the poor. They will be stuck in a decaying America. A land of economic failure riddled by crime and corruption, as can be seen in nearly every democrat controlled municipality (Detroit is a great example).

Socialism does work to create equality, in as much as eventually everyone becomes equally poor and downtrodden!