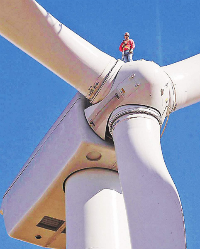

Jobs in Renewable Energy

At an ever-growing rate, I get calls and emails from people all over the world hoping that I can hook them up with clean energy jobs in the U.S. I wish I could help, but I can’t — at least, not at this point.

I’m hoping that this changes soon, but the U.S. is not embracing renewables to the degree I’d like to see. Did you know that there are more jobs in solar in Germany than there are jobs in steel in the U.S? I’m not proud of that, but it’s a fact. I believe that renewable energy will eventually win the day, but it doesn’t appear that the U.S. will be a leader in making this happen.

I get a bit puckish in my writings in the evening, perhaps because I typically have a martini as I make dinner for the Shields family.

I get a bit puckish in my writings in the evening, perhaps because I typically have a martini as I make dinner for the Shields family.