Infographic: The Pros and Cons of Renewable Energy

Whenever I speak on renewable energy, I’m careful to leave my audience with a sense of the “tough realities.” We all want simple answers to our questions, but in the case of clean energy, none exist.

There are dozens of different flavors of solar, wind, biomass, hydro, and geothermal, each improving in terms of cost and efficiency, but at different rates. There are economic issues, as none of these flavors can compete with the dirtiest form of coal, if we don’t take into account the “externalities” like lung disease and environmental damage. And Lord knows there are political issues, where we have serious candidates for president of the U.S. who, if elected, boldly pledge to dismantle our Environmental Protection Agency and Department of Energy. If this occurs, it would effectively end the efforts of the largest economy on Earth to migrate away from fossil fuels and nuclear. (more…)

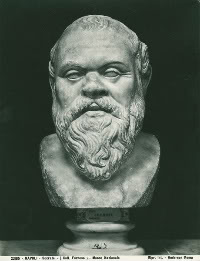

Last week, my son, a college freshman, sat down to his first class in philosophy.

Last week, my son, a college freshman, sat down to his first class in philosophy.