Should the News Coverage of the Energy Industry Meet Chevron's Approval?

I don’t think of myself as overly suspicious of the motives of others. But I have to say that I recoil at the end of every PBS NewsHour when Jim Lehrer signs off and we’re told that the broadcast was sponsored by Chevron. The idea that the information I just received met the approval of an oil company, with its obvious interests vis-à-vis clean energy, is deeply offensive. It certainly makes me call into question the validity of everthing I just heard.

Why does Chevron target PBS? I think the answer it pretty obvious: (more…)

An opinion poll from Civil Society Institute (CSI) said this week that key poll results reveal Tea Party members have quite different views on clean energy than Independents. The CSI poll is fully independent and not financed, supported, commissioned, conducted or released by any company, group, candidate or party.

An opinion poll from Civil Society Institute (CSI) said this week that key poll results reveal Tea Party members have quite different views on clean energy than Independents. The CSI poll is fully independent and not financed, supported, commissioned, conducted or released by any company, group, candidate or party.

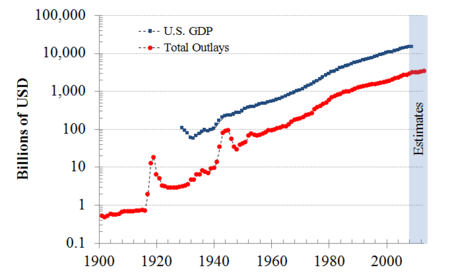

Congratulations to the Republicans on their victories yesterday, running successfully on the message of a smaller and more accountable government. But I hasten to point out that there is identically zero precedent for Republican’s (or Democrat’s) actually delivering on that promise. As shown on the graph below, historically, government bureaucracies are never removed; they grow roughly with the GDP regardless of who’s in power. But – for a few weeks at least – the people can feel that they’re being heard as a new set of agendas comes to Washington.

Congratulations to the Republicans on their victories yesterday, running successfully on the message of a smaller and more accountable government. But I hasten to point out that there is identically zero precedent for Republican’s (or Democrat’s) actually delivering on that promise. As shown on the graph below, historically, government bureaucracies are never removed; they grow roughly with the GDP regardless of who’s in power. But – for a few weeks at least – the people can feel that they’re being heard as a new set of agendas comes to Washington.

![[The Vector] News From Around the Country: Georgia Power to Double Solar](http://2greenenergy.com/wp-content/uploads/2010/10/Sun-and-Sky-with-clouds-150x150.jpg) The utility company Georgia Power reports it is doubling the amount of solar energy it will buy from independent producers. Lauren McDonald, Chair of the utility, said it will buy another 2.5 MW of capacity from homes and businesses with solar panels, to bring the total over 5 MW. 1 MW can power about 250 homes or one SuperTarget.

The utility company Georgia Power reports it is doubling the amount of solar energy it will buy from independent producers. Lauren McDonald, Chair of the utility, said it will buy another 2.5 MW of capacity from homes and businesses with solar panels, to bring the total over 5 MW. 1 MW can power about 250 homes or one SuperTarget.