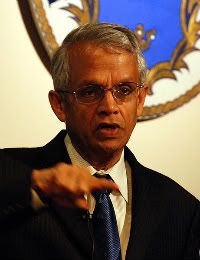

About Amir Mikhail, Contributor to “Renewable Energy Facts and Fantasies” – Wind Power

Dr. Mitchell contibuted to the book’s chapter on algae as biofuel.

Fundamentally, the photosynthetic process reduces inorganic compounds like carbon dioxide, water, nitrogen, and phosphorous, and builds these biochemicals. Initially sugar, and then the sugar’s burned to build all sorts of other things, and nutrients are brought in and you build membranes with phosphorous and you build proteins with nitrogen and so forth. It is all ultimately derived out of the sunlight.

There are many parts of NRDC. And certainly a watchdog function, as I think of it, has been traditionally and historically a big part of our activities. My work, in particular, has been in opposition to fossil fuel development on public lands. I’ve been at NRDC for more than 35 years now; my whole career has been devoted to defending the federal public lands – those that are managed by the Parks Service, the Bureau of Land Management, the Forest Service, and so forth. While I am also trying to prevent harmful and irresponsible renewable development, I am at the same time affirmatively trying to promote well-sited development.

Leadership action that Vectoris following was announced shortly after Obama’s Oval Office speech. It comes from former Senator Tom Daschle (Senior Fellow at the Center for American Progress) and a coalition of clean energy industries. Coalition members include, among others, the American Wind Energy Association, the Business Council for Sustainable Energy, the Biomass Power Association, the Geothermal Energy Association and the Solar Energy Industries Association.

At a press conference on June 23rd, the coalition called on the White House and Senate to take urgent action on legislation for clean energy. (more…)

The National Renewable Energy Laboratory, or NREL, is the only federal laboratory dedicated to the research, development, commercialization and deployment of renewable energy and energy efficiency technologies. I was delighted to speak with spokesperson George Douglas.

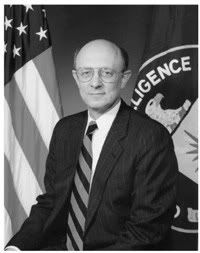

Mr. Woolsey is among the most vocal and, in my view, most credible proponents of renewables, making arguments touching on national security, global climate change, and economics. He is featured in Thomas Friedman’s Discovery Channel documentary Addicted to Oil, and in the 2006 documentary film “Who Killed the Electric Car?” which addresses solutions to oil dependency through the development of electric transportation. I was elated when his assistant responded positively to my request for an interview.