Government Subsidies for the Energy Industry in the U.S.

This is simply not true. I urge all readers to go through the comprehensive report on the subject compiled by the Environmental Law Institute linked from this blog post. I spent a couple of hours in the office in Washington D.C. a few years ago, interviewing two of the report’s authors, and asking them tough questions about the veracity of what they had published and how they had arrived at their numbers. I came away somewhat exhausted, but completely impressed.

Craig,

To be fair, there is an element of deliberate misdirection here.

The issue isn’t the relative value of government subsidies for fossil fuels, it’s the relative value PER UNIT ENERGY.

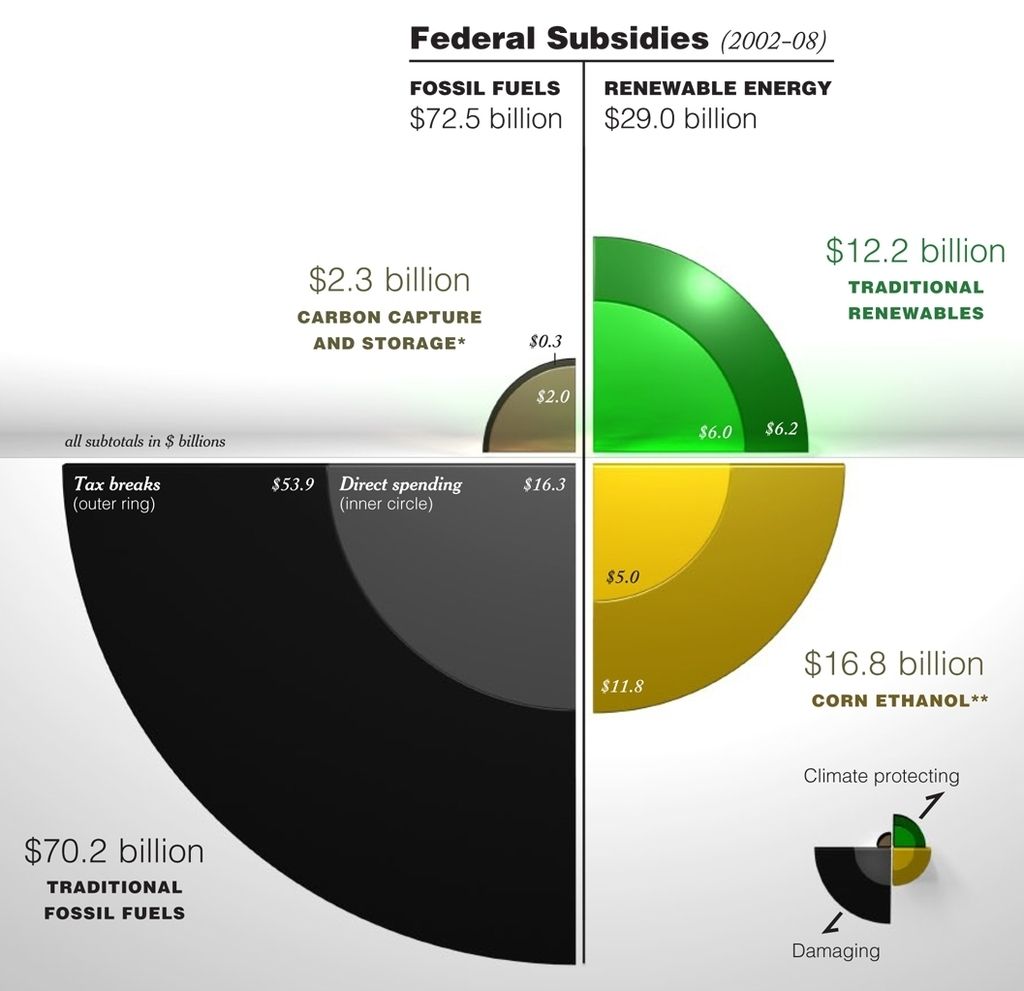

The identified 70.2 billion dollars in tax breaks and development subsidies for fossil fuels.would be amortized over ~2.75 PWh of generated electricity, ~4.75 billion bbl of petroleum and petroproducts, and 18.7 Tcf of natural gas (not counting the NG consumed by power plants) per year. If you were to divide the 70.2 billion dollars 3 ways, you’d find:

$8.50/MWh electricity

$0.13/therm of natural gas heating

$4.92/bbl of petroleum of petroproduct.

Meanwhile, the 16.8 billion for ethanol is neatly divided by 1.269 billion gallons for a total of:

$13.24/gallon (113 times the total support offered to liquid fossil fuels),

While the 12.2 billion dollars offered to traditional renewables would arguably be amortized among 281 TWh of generated electricity from non-hydropower renewable sources, for a total of $43.42/MWh (5 times the estimated support for fossil based electric generation).

Clearly, more is being offered for renewables than fossil energy – as it should be.

But in light of the clear discrepancy between the support for renewables and fossil energy – even in the most aggressively exaggerated case (as presented by the Environmental Law Institute), it is not worth either time or effort to attempt to somehow “stamp out” the remaining support for fossil fuels. Note that often this identified “support” includes things like energy credits for low income households, subsidies to encourage energy distribution into low population regions, and support for greater smokestack emissions control or processes which remove more contaminants (Granted there are a few tax provisions – like depreciation of land value – that are clearly questionable and should be withdrawn… but still).

The goal should be identifying the disparity within the renewable umbrella and trying to make things more sensible. At $13/gallon, the total investment offered for biofuels is INSANE, considering the very small environmental gain afforded. If that were instead distributed to traditional renewables, that would yield a much greater return for the environment.

In the same vein, $43/MWh is greater than the TOTAL LCOE for wind energy in class 5 wind zones. Even if extraordinary percentages (>50%) had to be curtailed, this would ensure tremendous growth in total power generation… but yet the total YOY growth in traditional generation for 2014 was a paltry 27.5 TWh. 27.5 TWh!!! That’s only around 0.6% of our total electric power generation. With $12.2 billion, we should easily be increasing our generation by well over 100 TWh/year – possibly as much as 200 TWh/year… but it’s so poorly managed as a result of incompetence, corruption, and fraud, that we’re seeing very poor returns, which of course gives the republicans very legitimate talking points about the waste of money in the green sector and how environmentalists don’t care about the environment… it’s all about distributing money to their friends..

THAT’s what we need to be concerned about. We need to remove the beam from our own eye before worrying over the motes found in the eyes of others.

Excellent insights. Please see: http://2greenenergy.com/2015/04/27/government-subsidies-for-fossil-fuels-renewable-energy/.